Fund performance (net)

Fund |

Fund (%) |

Index/median (%) |

Aegon Strategic Global Bond Fund* |

1.41 |

0.70 |

Aegon High Yield Global Bond Fund* |

0.75 |

0.85 |

Aegon Investment Grade Global Bond Fund* |

0.91 |

1.35† |

Aegon Global Short Dated High Yield Climate Transition Fund** |

0.59 |

0.39 |

Aegon Absolute Return Bond Fund*** |

0.56 |

0.41 |

Aegon Global Short Dated Climate Transition Fund**** |

0.55 |

0.38 |

- There was no shortage of newsworthy macro developments in November, leading to volatility in global government bonds.

- The US election and subsequent Fed meeting, continued ratcheting up of tensions in Ukraine, and wranglings in German and French politics all contributed to a volatile backdrop.

- Despite the turbulence, 10-year yields in the US, UK and Germany all fell, confounding the consensus view that a Trump victory would see an increase in government bond yields.

- Credit spreads rallied following the US election result, with risk assets favouring the certainty provided by a clear outcome.

- On the rates front we had tactically reduced duration and benefited from rotating into Europe out of the US earlier in the period, given the volatility seen in the latter.

- In credit, we continued to benefit from exposure to thematic stories that we have liked all year.

- This included our holdings in names such as CPI property Group, Heimstaden and Metro Bank.

- Our overall light exposure to generic credit spreads helped our relative performance further.

-

The fund benefited from the spread tightening seen in high yield bond sector.

-

Throughout the month, we continued the focus on investing for income generation and high carry via high-coupon bonds.

-

Given tight spread levels, we are maintaining a defensive positioning to help insulate the fund from potential spread widening and downside risk.

-

Despite the defensive positioning, the fund broadly kept pace with the ICE BofA Global High Yield TR USD Hedged index in November, partly driven by higher carry.

- While credit spreads rallied following the US election result, euro spreads underperformed against dollar spreads, which was unfavourable for the fund on a relative basis.

- We reduced, to a small extent, overall funds duration mid-month, leaving it in line with the index at just over 6 years.

- Longer-dated US dollar holdings performed strongly, with Oracle and Warner Media among the notable names.

- Performance was more challenging in certain French banking names towards the end of the month, including BNP and Societe Generale.

- The fund was an active participant in the pick-up in global new issuance which followed the US election. We purchased, among others, a new issue from Commerzbank and a subordinated issue from TotalEnergies.

†The fund will have seen some detriment relative to the index due to the fund pricing at midday - and the index at close. November’s index performance therefore will include the impact of the approximately 5bps rally in Treasuries witnessed between midday and close at end November.

Please note that from 14 June 2024 changes have been made to this fund in terms of the climate transition categories and allocations set – see the fund page on the website for more details.

- The inverted yield curve continues to present compelling opportunities to add yield in short-dated bonds.

- We are focused on investing in higher-quality bonds that have elevated coupon rates, which can increase yields and reduce volatility.

- During the month, we increased exposure to certain companies that have solid climate transition characteristics and offer attractive yields.

- The Credit module performed well over the month, with solid gains coming from the collection of hedged corporate bonds.

- Through careful bottom-up security selection, value was added from a range of holdings, including bonds issued by Santander, Traton and Aroundtown.

- The bond-CDS basis positions also added value, while the balance of the CDS relative value positions was broadly flat over the month.

- The Rates module detracted slightly, with our Australian 3yr vs 10yr curve steepening position detracting as the market moved to price-out the amount of easing expected from the RBA.

- Towards the end of the month, our long positions in 10yr UK and 10yr Germany vs a short position in 10yr US also contributed positively.

- The Carry performed well as the demand for short dated corporate bonds helped drive further performance in these assets.

- We saw gains from bonds issued by Centre Parcs, RAC and Ford amongst a range of other issuers.

Please note that from 14 June 2024 changes have been made to this fund in terms of the climate transition categories and allocations set – see the fund page on the website for more details.

- The most significant positive contributors to fund performance tended to be derived from our shorter euro-denominated holdings.

- Once again, holdings in real estate and subordinated financials feature towards the top of the list.

- The recently added exposure to Via Outlets alongside Deutsche Bank and CNP were among the standout names.

- The fund's exposure to Center Parcs also contributed positively as the company issued new debt and called outstanding paper.

- While few holdings delivered a negative total return, underperformers included two of the fund's high yield positions - Kier Group and B&M Retail.

- The fund's headline duration remained unchanged throughout the month at approximately 2.6 years.

- The sharp move lower in underlying government bond yields in Europe and the UK more than compensated for the slightly wider credit spreads in these markets on the month.

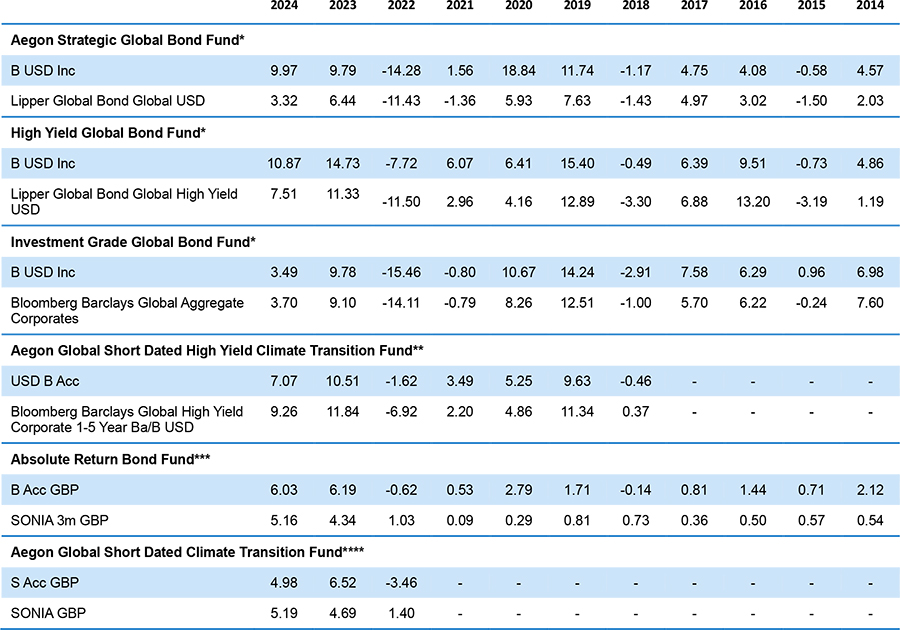

*Source: Lipper as at 30 November 2024. Performance shown is for the B USD Inc share class.

**Source: Lipper as at 30 November 2024. Performance shown is for the B USD Acc share class. On the 18 December 2023, the name changed from the Aegon Short Dated High Yield Global Bond Fund to the Aegon Global Short Dated High Yield Climate Transition Fund.

***Source: Lipper as at 30 November 2024. Performance shown is for the B GBP Acc share class.

****Source: Lipper as at 30 November 2024. Performance shown is for the S GBP Acc share class. Share class inception 4 March 2021. On the 15 July 2022, the name changed from the Aegon Short Dated Investment Grade Bond Fund to the Aegon Global Short Dated Climate Transition Fund.

Performance drivers discussed within this flash report may be based on preliminary attribution reports, which can differ from final month-end attribution. NAV to NAV, noon prices, income reinvested, net of ongoing charges, excluding entry or exit charges. Past performance is not a guide to future returns. The Funds are incorporated in the following Lipper Global peer groups - Aegon Strategic Global Bond Fund is in the Bond Global sector, Aegon High Yield Global Bond Fund is in the Bond Global High Yield sector. Benchmark and sector median source: Lipper. Aegon Investment Grade Global Bond Fund is measured versus the Barclays Global Aggregate Corporate. Aegon Absolute Return Bond Fund is measured against SONIA 3 Month GBP. Aegon Global Short Dated Climate Transition Fund is measured against SONIA GBP. Aegon Global Short Dated High Yield Climate Transition Fund is measured against SOFR USD.

Sign up for the Aegon AM Fixed Income funds monthly email, for latest performance numbers and fund updates, and the BondTalk update.

The main risks of investing in these funds are:

Credit |

Liquidity |

Counterparty |

Other markets |

Concentration |

Derivatives |

Interest Rates |

Fund charges |

|

Strategic Global Bond Fund |

✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ | |

High Yield Global Bond Fund |

✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ |

Investment Grade Global Bond Fund |

✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ||

Global Short Dated High Yield Climate Transition Fund |

✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ |

Absolute Return Bond Fund |

✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ||

Global Short Dated Climate Transition Fund |

✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ |

For more information on the risks involved with these funds please see the Prospectus/KIID.

*Source: Lipper as at 31 December 2023. Performance shown is for the B USD Inc share class.

**Source: Lipper as at 31 December 2023. Performance shown is for the B USD Acc share class. On the 18 December 2023, the name changed from the Aegon Short Dated High Yield Global Bond Fund to the Aegon Global Short Dated High Yield Climate Transition Fund.

***Source: Lipper as at 31 December 2023. Performance shown is for the B GBP Acc share class. The benchmark changed from LIBOR to SONIA on or around 9th of December 2021.

****Source: Lipper as at 31 December 2023. Performance shown is for the S GBP Acc share class. Share class inception 4 March 2021. On the 15 July 2022, the name changed from the Aegon Short Dated Investment Grade Bond Fund to the Aegon Global Short Dated Climate Transition Fund.

NAV to NAV, noon prices, income reinvested, net of ongoing charges, excluding entry or exit charges. Past performance is not a guide to future returns. The Funds are incorporated in the following Lipper Global peer groups - Aegon Strategic Global Bond Fund is in the Bond Global sector, Aegon High Yield Global Bond Fund is in the Bond Global High Yield sector. Benchmark and sector median source: Lipper. Aegon Investment Grade Global Bond Fund is measured versus the Barclays Global Aggregate Corporate. Aegon Absolute Return Bond Fund is measured against SONIA 3 Month GBP. Aegon Global Short Dated Climate Transition Fund is measured against SONIA GBP. Aegon Global Short Dated High Yield Climate Transition Fund is actively managed and is not constrained by any benchmark, other than the Bloomberg Global High Yield Corporate 1-5 Year Ba/B Index which is used as a reference point to measure carbon intensity.

For Professional Clients only and not to be distributed to or relied upon by retail clients.

This is a marketing communication. Please refer to the following legal documents of the UCITS before making any final investment decisions. For UK investors: This product is based overseas (Ireland) and is not subject to UK sustainable investment labelling and disclosure requirements. Please read the Key Investor Information, Prospectus, Supplementary Information Document and Application Form carefully. Consider getting financial advice if you need help to understand the investment and both the risks and opportunities involved. This product is authorised overseas but not in the United Kingdom and the Financial Ombudsman Service is unlikely to be able to consider complaints related to the product, its operator or depositary. Any claims for losses relating to the operator or depositary of this product are unlikely to be covered under the Financial Services Compensation Scheme. For EU investors: please refer to the Prospectus and the PRIIPs KID. The relevant documents can be found at aegonam.com. The principal risk of this product is the loss of capital.

Past performance does not predict future returns. Outcomes, including the payment of income, are not guaranteed.

All investments contain risk and may lose value. Responsible investing is qualitative and subjective by nature, and there is no guarantee that the criteria utilized, or judgement exercised, by any company of Aegon Asset Management will reflect the beliefs or values of any one particular investor. Responsible investing norms differ by region. There is no assurance that the responsible investing strategy and techniques employed will be successful. Investors should consult their investment professional prior to making an investment decision.

Opinions and/or example trades/securities represent our understanding of markets both current and historical and are used to promote Aegon Asset Management's investment management capabilities: they are not investment recommendations, research or advice. Sources used are deemed reliable by Aegon Asset Management at the time of writing. Please note that this marketing is not prepared in accordance with legal requirements designed to promote the independence of investment research, and is not subject to any prohibition on dealing by Aegon Asset Management or its employees ahead of its publication.

Fund Charges are taken from income but will be taken from capital where income is insufficient to cover charges, except the Aegon High Yield Global Bond Fund and Aegon Global Short Dated High Yield Climate Transition Fund where the fund charges are deducted from capital which has the effect of increasing income distributions but constraining capital growth.

All data is sourced to Aegon Asset Management UK plc unless otherwise stated. The document is accurate at the time of writing but is subject to change without notice.

Data attributed to a third party (“3rd Party Data”) is proprietary to that third party and/or other suppliers (the “Data Owner”) and is used by Aegon Asset Management UK plc under licence. 3rd Party Data: (i) may not be copied or distributed; and (ii) is not warranted to be accurate, complete or timely. None of the Data Owner, Aegon Asset Management UK plc or any other person connected to, or from whom Aegon Asset Management UK plc sources, 3rd Party Data is liable for any losses or liabilities arising from use of 3rd Party Data.

Aegon Asset Management Investment Company (Ireland) Plc (AAMICI) is an umbrella type open-ended investment company which is authorised and regulated by the Central Bank of Ireland. Aegon Investment Management B.V (Aegon AM NL) is the appointed management company. Aegon AM NL is registered with and supervised by the Dutch Authority for Financial Markets (AFM). Aegon AM NL's German branch markets AAMICI in Germany, Austria and Switzerland, is registered with and supervised by the AFM and supervised by BaFin in Germany. Aegon AM NL’s branch in Spain markets AAMICI in Spain, Italy and Switzerland. Aegon AM NL's Spanish branch is registered with and supervised by the AFM and is supervised by the CNMV in Spain. For Switzerland, AAMICI is a UCITS which is authorised for distribution by FINMA as a Foreign Collective Investment Scheme. The Disclosures are available from www.aegonam.com or from the Representative and Paying Agent in Switzerland, CACEIS (SA) Switzerland, Chemin de Precossy 7-9, CH-1260 Nyon / VD, Suisse, Phone: +41 22 360 94 00, Fax: +41 22 360 94 60.

Aegon AM UK markets AAMICI in the UK and otherwise outside of the EEA. Aegon Asset Management UK plc (Aegon AM UK) is authorised and regulated by the Financial Conduct Authority.

Please note that not all sub-funds and share classes may be available in each jurisdiction. This content is marketing and does not constitute an offer or solicitation to buy any fund(s) mentioned. No promotion or offer is intended other than where the fund(s) is/are authorized for distribution.

Please visit www.aegonam.com/en/contact/ for an English summary of investor rights and more information on access to collective redress mechanisms.

Adtrax: 4532546.67 | Expiry 31 December 2025