After high yield bonds delivered strong returns again in 2024, many investors are wondering if the asset class can continue to perform in 2025. With spreads around historically tight levels, some investors are cautious on high yield bonds in fear of potential spread widening. Although the macroeconomic outlook remains uncertain and credit spreads may be biased toward widening, we believe high yield bonds can play a key role in investors’ portfolios. From attractive long-term return potential to enhanced yields and high income, we think there are many reasons to consider high yield bonds.

When assessing the attractiveness of high yield bonds, there are two main perspectives to evaluate – the tactical, short-term view and the structural, long-term view. From a structural perspective, global high yield offers evergreen appeal and has delivered strong risk-adjusted returns versus many other fixed income assets with equity-like returns and lower volatility. From a tactical perspective, high yield bonds offer opportunities in the current environment for enhanced yields and high-income opportunities. Further, the breakeven profile of the asset class today can help cushion against potential spread volatility. Overall, we think there are five key factors that favor high yield bonds now.

1. Compelling total return potential |

|

2. Diversification benefits |

|

3. Enhanced yields |

|

4. Supportive breakeven |

|

5. High income opportunities |

|

1. Compelling total return potential

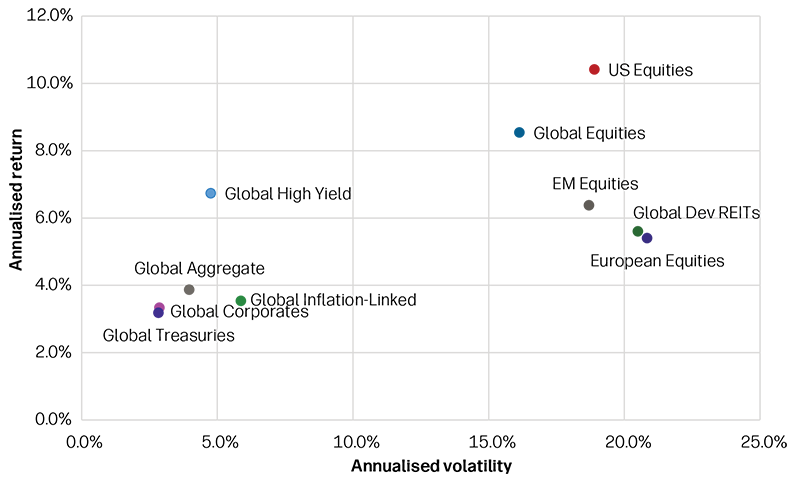

High yield bonds offer evergreen appeal with attractive risk-adjusted returns. Relative to other fixed income asset, high yield can provide enhanced returns for a given level of risk, or volatility. Exhibit 1 highlights the strong risk-adjusted returns of global high yield over a 20-year period relative to other asset classes. As shown, high yield bonds have delivered equity-like returns, but with significantly lower volatility. This provides investors compelling risk-adjusted return potential over the long term.

Exhibit 1: Equity-like returns with lower volatility

20-year asset class risk vs. return profiles based on index data

Past performance does not predict future returns. Source: Bloomberg, MSCI and S&P. As of 31 December 2024. Reflects annualized total return and standard deviation (volatility) over a 20-year period to 31 December 2024. Based on daily returns hedged to USD. Includes the following indices: Bloomberg Global High Yield TR for 'Global High Yield'; Bloomberg Global Aggregate TR for 'Global Aggregate'; Bloomberg Global Aggregate Corporates TR for 'Global Corporates'; Bloomberg Global Inflation Linked TR for 'Global Inflation Linked'; Bloomberg Global Treasury TR for 'Global Treasury'; MSCI World TR for 'Global Equities'; MSCI Emerging Markets Total Return USD for 'EM Equities’; MSCI Europe TR for 'European Equities'; MSCI USA TR for 'US Equities'; and S&P Developed REIT TR USD for 'Global Dev. REITS’. It is not possible to invest directly in an index. All investments contain risk and may lose value.

For investors looking to de-risk their equity portfolio, high yield bonds may be a natural option. Many investors include an allocation to high yield bonds in their portfolio in an effort to add income. In addition, allocating to high yield bonds doesn’t have to mean sacrificing returns as high yield bonds have the potential to deliver equity-like returns over the long term, but with lower volatility.

2. Diversification benefits

High yield bonds can offer enhanced diversification benefits, including relatively low correlations to other fixed income investments and lower interest rate sensitivity. As shown in Exhibit 2, high yield has historically had relatively low correlations to other fixed income assets and equities, which can help investors diversify their portfolios. Further, high yield bonds typically have low duration, making them less sensitive to interest-rate movements relative to longer-duration bonds. This duration point is central to the diversification argument as both riskier assets, such asequities, and risk-free assets, such as US Treasuries, have proven to be highly duration/interest-rate sensitive in recent times, something by nature high yield is not.

Exhibit 2: Five-year correlation of various fixed income and equity indices

Source: Bloomberg, BofA, five-year correlation as at 31 December 2024. Indices are Bloomberg US Corporate High Yield; ICE BofA 1-10 Year US Corporate; ICE BofA 1-10 Year US Treasury; S&P 500 Total Return; Russell 2000. Based on monthly USD returns. It is not possible to invest directly in an index. All investments contain risk and may lose value.

3. Enhanced yields provide compelling long-term return potential

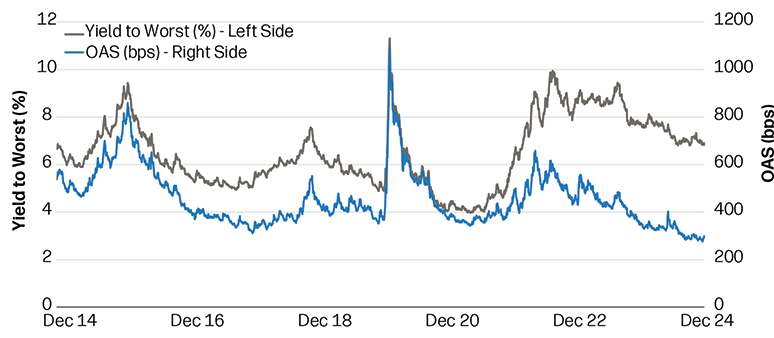

Although the structural case for high yield persists with attractive long-term return potential and diversification benefits, from a tactical perspective the valuations of the asset class today paint a mixed picture. The global high yield market, measured by the ICE BofA Global High Yield Index, continues to offer attractive yields around 7%, however spreads are around historically tight levels1. This presents a valuations conundrum for high yield investors as they debate their high yield allocations and entry points.

Exhibit 3: Yields are high, spreads are tight

ICE BofA Global High Yield Index YTW vs spreads (OAS)

Source: Bloomberg, ICE BofA. Updated as of 28 February 2025. Reflects the daily yield to worst and option-adjusted spread for the ICE BofA Global High Yield Constrained index from 31 December 2014 –28 February 2025.

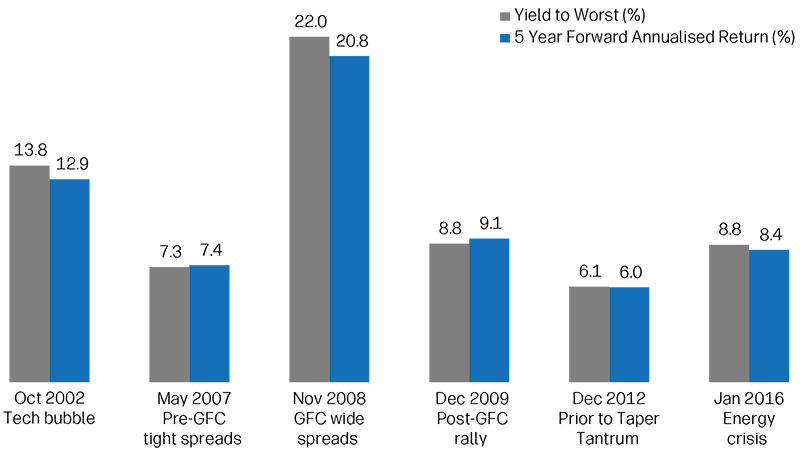

While there are many ways to evaluate the asset class (yields, spreads, expected returns, etc.), historically the starting yield has been a good indicator of future returns. As shown in Exhibit 4, the starting yield on the index has generally been a reliable indicator of the future five-year annualized return. This relationship has held true in both wide and tight spread environments, illustrating that the starting yield tends to be a better predictor of return potential than spreads.

Exhibit 4: Yield as an indicator of five-year return potential

ICE BofA Global High Yield Index YTW and forward five-year index returns

Source: Aegon AM, Bloomberg, ICE BofA. Chart reflects the daily yield to worst and option-adjusted spread for the ICE BofA Global High Yield (HW00) index from December 2014 – December 2024. It is not possible to invest directly in an index. All investments contain risk and may lose value.

With the current yield to worst on the ICE BofA Global High Yield index around 7% (as of February 2025), we think the future total return potential of the asset class over the next five years looks attractive1. That said, markets do not move in a straight line and investors will likely need to weather some short-term volatility. With spreads around historically tight levels, we believe spreads are likely biased toward widening. However, it is possible that tight spreads could hang around, particularly when there is a heavily positive technical underpinning the market with demand for high yield bonds outpacing supply (as is the case currently). And in the absence of a clear catalyst for spread widening, there are no guarantees that a better entry point is just around the corner. Nonetheless, it is relatively rare for spreads to stay at compressed levels for long.

In the world of high yield, a period of weakness will inevitably show up sooner or later. It can be incredibly hard to predict the path of credit spreads. It could be that high yield tightens beyond all-time tight levels, or spreads could go wider from here. While passing the time however, we contend it is better to be paid to get in the game, rather than sit on the sidelines. Although valuations are stretched with tight spreads, we continue to like the yield and carry available in the market.

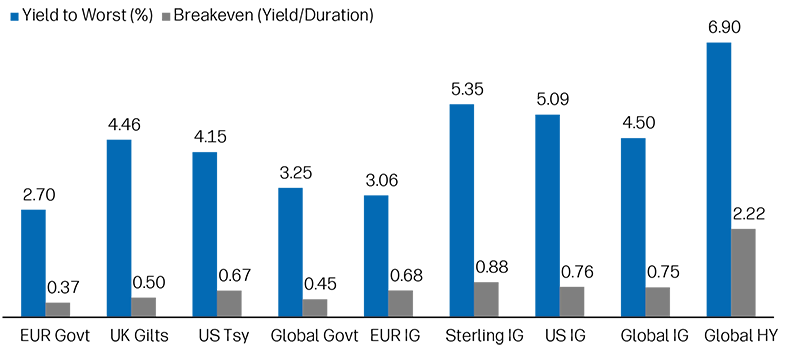

4. Supportive breakeven profile

In addition to elevated yields, high yield bonds can offer a defensive breakeven. The breakeven is the yield divided by duration. This measures how high yields (or spreads) would need to rise before the total return of a bond becomes negative, typically over a one-year time horizon. Even if spreads or yields widen from here, the breakeven rate for high yield bonds is now considerably more attractive. The higher breakeven available for high yield bonds of over 2% means that spreads would need to widen more than 200 basis points before the price return would turn negative. This cushion is the biggest it has been for over a decade and can help add some defensiveness to high yield portfolios and further supports the case for why high yield now.

Exhibit 5: High yield bonds offer an enhanced breakeven

Yield and breakeven for various fixed income indices

Source: Bloomberg and ICE BofA. Reflects the yield to worst and breakeven (yield to worst / effective duration) for various ICE BofA indices as of 28 February 2025. Includes the following indies: ICE BofA All Euro Government, ICE BofA UK Gilt, ICE BofA US Treasury, ICE BofA Global Government, ICE BofA Euro Corporate, ICE BofA Sterling Corporate, ICE BofA US Corporate, ICE BofA Global Corporate, ICE BofA Global High Yield Constrained. It is not possible to invest directly in an index. All investments contain risk and may lose value.

5. High income opportunities

In addition to elevated yields and an enhanced breakeven profile, high yield bonds offer compelling income opportunities. For income-oriented investors, now is the time for bonds. As rates shifted higher in recent years, coupon rates on newly issued bonds continued to climb higher, offering income opportunities rarely seen in recent years.

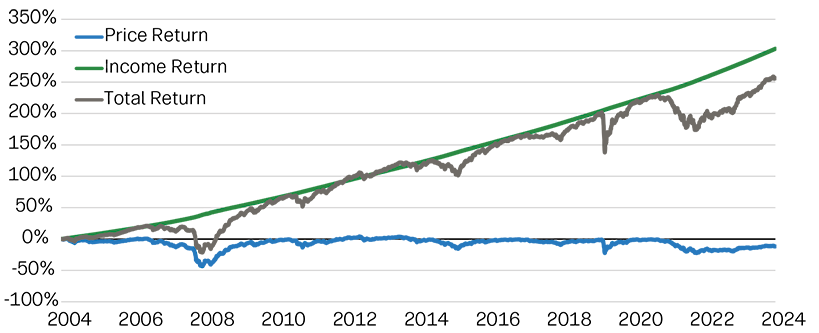

Although markets may be volatile and prices will likely fluctuate, income available on high yield bonds can provide steady carry. After all, income tends to drive returns over the long-term in the high yield market. As shown in Exhibit 6, income has been the largest driver of fixed income total returns over the long term. The income, or carry, from coupons can also provide a buffer against price movements. While prices can be volatile, income has historically provided a steady return over time.

Exhibit 6: Income, not price, is the main driver of high yield bond returns

Cumulative price and income return of the ICE BofA Global High Yield Index

Source: Bloomberg and ICE BofA. As of 31 December 2024. Reflects the price and income return for the ICE BofA Global High Yield Constrained index. Past performance does not predict future returns. It is not possible to invest directly in an index. All investments contain risk and may lose value.

Some investors have been hesitant to add exposure to high yield given tight spread levels and concerns about price volatility amid macro uncertainty. For example, let’s look at 2024. At the beginning of the year, spreads were around multi-year tight levels. However, those investors that were not invested in the asset class would have missed out on a 9% total return in 2024 (ICE BofA Global High Yield Index, USD hedged return1). Spreads continued to tighten even further in 2024 as a result of the ongoing risk-on trade and the asset class was supported by steady carry. This indicates the potential benefit of being invested in the asset class and the benefit of carry. Investors today can access higher coupon rates and potentially get paid high income, while others sit on the sidelines waiting. As the age-old saying goes, it is time in the market, not timing the market that matters.

Summary

Looking ahead, the high yield bond market continues to provide compelling opportunities with elevated yields and high income. Markets could face pockets of volatility; however, the structural case for high yield persists as the asset class can offer equity-like returns with lower volatility over the long term. In addition, high yield bonds provide opportunities to diversify broader portfolios as the asset class benefits from a low duration and relatively low correlations to other asset classes. Further, high yield bonds continue to offer attractive yields, and although spreads are tight, the starting yield has historically been a good indicator of the future return potential. Additionally, high yield bonds currently benefit from a high breakeven, which can help provide some defensiveness against spread widening. Finally, for income-oriented investors, bonds present opportunities as the high yield asset class can provide high income and steady carry.

1 It is not possible to invest directly in an index. All investments contain risk and may lose value.

Monthly update about our dedicated fixed income blog, providing regular insight into the ideas, debate and opinion behind our portfolios and strategy, straight from the fixed income desk.