Fund performance (net)

Fund |

Fund (%) |

Index/median (%) |

Aegon Strategic Global Bond Fund* |

2.66 |

1.25 |

Aegon High Yield Global Bond Fund* |

1.34 |

1.45 |

Aegon Investment Grade Global Bond Fund* |

1.66 |

1.19 |

Aegon Global Short Dated High Yield Climate Transition Fund** |

0.82 |

0.43 |

Aegon Absolute Return Bond Fund*** |

0.49 |

0.44 |

Aegon Global Short Dated Climate Transition Fund**** |

0.91 |

0.41 |

- Fixed income markets experienced a memorable month in August with bouts of extreme volatility causing bond prices to fluctuate significantly.

- A combination of weaker than expected employment data and skewed positioning in risky assets (equities primarily) prompted a sharp risk-off environment that steadily unwound over the remainder of the month.

- Against this backdrop, both government and corporate bonds delivered positive total returns.

- 10-year government bond yields were lower in the US by 12bps at 3.90% but broadly unchanged in Germany and the UK at 2.30% and 4.02% respectively.

- Yield curves were steeper, with short-dated bonds benefitting from building rate-cut expectations, allowing them to outperform longer dated assets - this was most pronounced in the US.

- Both investment grade and high yield corporate bonds shrugged off the early month volatility to deliver robust, positive total returns.

- We had a duration of 8-years at the start and end of the month, but it was reduced to 7-years mid-month as government bond yields fell.

- Our duration level was beneficial as yields fell - the subsequent reduction in interest rate risk offered some cushion as yields then backed up.

- Curve positioning added value with our preference for shorter dated bonds performing well.

- Having a lower level of credit risk as the month opened helped protect the fund as spreads moved sharply wider.

- We then tactically added credit risk, allowing the fund to benefit from the recovery that followed.

- Exposure to European real estate names and REITs contributed positively, as they benefit from expectations of lower interest rates.

- Our lower exposure to CCCs and relatively neutral beta positioning worked against us this month as lower quality credit rebunded.

- In terms of positive contributors, the higher-quality holdings and modest exposure to investment grade bonds added value.

- We are positioned for income generation and downside protection with a focus on higher quality credit which slightly detracted.

- However, given the environment, we believe it is prudent to be cautious and can see this positioning benefitting the fund in the future.

- We removed a short position from July after an uptick in volatility as we believed it had less predictability than we had initially hoped.

- Positive developments across the property sector led to strong results from WP Carey and Heimstaden.

- We purchased new dollar issues from GE Healthcare and from supermarket chain Kroger as well as a new issue from Coca Cola in euros.

Please note that from 14 June 2024 changes have been made to this fund in terms of the climate transition categories and allocations set – see the fund page on the website for more details.

- By ratings, our preference for higher-quality bonds added value as BB-rated bonds contributed the most.

- Our key positioning themes include preferring higher-quality, high coupon bonds that provide steady carry and income.

- We invest in companies that take credible steps to transition their businesses and we select bonds with attractive return characteristics.

- The Credit module was positive with contributors including Aroundtown, HSBC, and Société Générale.

- The position we hold in Intesa Sanpaolo senior debt also performed well generating alpha for the fund.

- The Rates module was more mixed, ultimately finishing flat.

- Our UK 2-year vs 10-year steepening trade, and US 5-year vs 30-year steepening position, both supported returns.

- In contrast, a cross-market position where we are long ultra long UK gilts maturing in 2061 and short 30-year US Treasury futures detracted.

- The Carry module did well and we saw gains from a diversified range of names including Deutsche Bank, Nissan and Rothesay Life.

Please note that from 14 June 2024 changes have been made to this fund in terms of the climate transition categories and allocations set – see the fund page on the website for more details.

- We made a small increase to the fund's UK duration exposure, taking the fund's overall duration to a little over 2.5 years.

- Positions in US dollar denominated bonds typically made the highest contribution, these included positions in bonds from EDP, Morgan Stanley, and Goldman Sachs.

- A number of the fund's positions in the real estate sector also performed well, most notably bonds from Heimstaden Bostad and Canary Wharf.

- The only new addition to the fund was a small position in bonds from Aroundtown, the pan-European real estate company

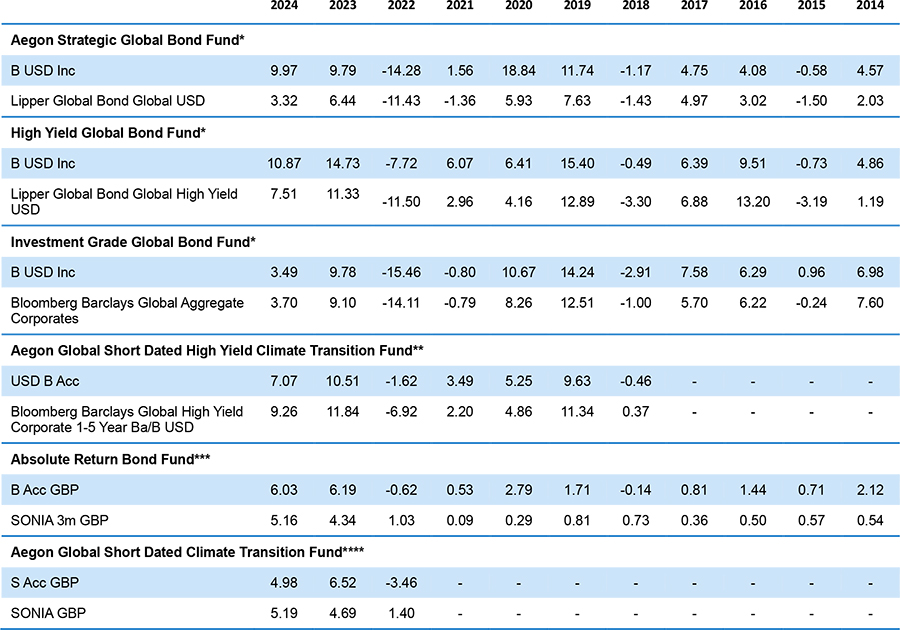

*Source: Lipper as at 31 August 2024. Performance shown is for the B USD Inc share class.

**Source: Lipper as at 31 August 2024. Performance shown is for the B USD Acc share class. On the 18 December 2023, the name changed from the Aegon Short Dated High Yield Global Bond Fund to the Aegon Global Short Dated High Yield Climate Transition Fund.

***Source: Lipper as at 31 August 2024. Performance shown is for the B GBP Acc share class.

****Source: Lipper as at 31 August 2024. Performance shown is for the S GBP Acc share class. Share class inception 4 March 2021. On the 15 July 2022, the name changed from the Aegon Short Dated Investment Grade Bond Fund to the Aegon Global Short Dated Climate Transition Fund.

Performance drivers discussed within this flash report may be based on preliminary attribution reports, which can differ from final month-end attribution. NAV to NAV, noon prices, income reinvested, net of ongoing charges, excluding entry or exit charges. Past performance is not a guide to future returns. The Funds are incorporated in the following Lipper Global peer groups - Aegon Strategic Global Bond Fund is in the Bond Global sector, Aegon High Yield Global Bond Fund is in the Bond Global High Yield sector. Benchmark and sector median source: Lipper. Aegon Investment Grade Global Bond Fund is measured versus the Barclays Global Aggregate Corporate. Aegon Absolute Return Bond Fund is measured against SONIA 3 Month GBP. Aegon Global Short Dated Climate Transition Fund is measured against SONIA GBP. Aegon Global Short Dated High Yield Climate Transition Fund is measured against SOFR USD.

Sign up for the Aegon AM Fixed Income funds monthly email, for latest performance numbers and fund updates, and the BondTalk update.

The main risks of investing in these funds are:

Credit |

Liquidity |

Counterparty |

Other markets |

Concentration |

Derivatives |

Interest Rates |

Fund charges |

|

Strategic Global Bond Fund |

✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ | |

High Yield Global Bond Fund |

✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ |

Investment Grade Global Bond Fund |

✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ||

Global Short Dated High Yield Climate Transition Fund |

✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ |

Absolute Return Bond Fund |

✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ||

Global Short Dated Climate Transition Fund |

✘ | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ |

For more information on the risks involved with these funds please see the Prospectus/KIID.

*Source: Lipper as at 31 December 2023. Performance shown is for the B USD Inc share class.

**Source: Lipper as at 31 December 2023. Performance shown is for the B USD Acc share class. On the 18 December 2023, the name changed from the Aegon Short Dated High Yield Global Bond Fund to the Aegon Global Short Dated High Yield Climate Transition Fund.

***Source: Lipper as at 31 December 2023. Performance shown is for the B GBP Acc share class. The benchmark changed from LIBOR to SONIA on or around 9th of December 2021.

****Source: Lipper as at 31 December 2023. Performance shown is for the S GBP Acc share class. Share class inception 4 March 2021. On the 15 July 2022, the name changed from the Aegon Short Dated Investment Grade Bond Fund to the Aegon Global Short Dated Climate Transition Fund.

NAV to NAV, noon prices, income reinvested, net of ongoing charges, excluding entry or exit charges. Past performance is not a guide to future returns. The Funds are incorporated in the following Lipper Global peer groups - Aegon Strategic Global Bond Fund is in the Bond Global sector, Aegon High Yield Global Bond Fund is in the Bond Global High Yield sector. Benchmark and sector median source: Lipper. Aegon Investment Grade Global Bond Fund is measured versus the Barclays Global Aggregate Corporate. Aegon Absolute Return Bond Fund is measured against SONIA 3 Month GBP. Aegon Global Short Dated Climate Transition Fund is measured against SONIA GBP. Aegon Global Short Dated High Yield Climate Transition Fund is actively managed and is not constrained by any benchmark, other than the Bloomberg Global High Yield Corporate 1-5 Year Ba/B Index which is used as a reference point to measure carbon intensity.

For Professional Clients only and not to be distributed to or relied upon by retail clients.

This is a marketing communication. Please refer to the following legal documents of the UCITS before making any final investment decisions. For UK investors: please refer to the Prospectus and the UCITS KIID. For EU investors: please refer to the Prospectus and the PRIIPs KID. The relevant documents can be found at aegonam.com. The principal risk of this product is the loss of capital.

Past performance does not predict future returns. Outcomes, including the payment of income, are not guaranteed.

All investments contain risk and may lose value. Responsible investing is qualitative and subjective by nature, and there is no guarantee that the criteria utilized, or judgement exercised, by any company of Aegon Asset Management will reflect the beliefs or values of any one particular investor. Responsible investing norms differ by region. There is no assurance that the responsible investing strategy and techniques employed will be successful. Investors should consult their investment professional prior to making an investment decision.

Opinions and/or example trades/securities represent our understanding of markets both current and historical and are used to promote Aegon Asset Management's investment management capabilities: they are not investment recommendations, research or advice. Sources used are deemed reliable by Aegon Asset Management at the time of writing. Please note that this marketing is not prepared in accordance with legal requirements designed to promote the independence of investment research, and is not subject to any prohibition on dealing by Aegon Asset Management or its employees ahead of its publication.

Fund Charges are taken from income but will be taken from capital where income is insufficient to cover charges, except the Aegon High Yield Global Bond Fund and Aegon Global Short Dated High Yield Climate Transition Fund where the fund charges are deducted from capital which has the effect of increasing income distributions but constraining capital growth.

All data is sourced to Aegon Asset Management UK plc unless otherwise stated. The document is accurate at the time of writing but is subject to change without notice.

Data attributed to a third party (“3rd Party Data”) is proprietary to that third party and/or other suppliers (the “Data Owner”) and is used by Aegon Asset Management UK plc under licence. 3rd Party Data: (i) may not be copied or distributed; and (ii) is not warranted to be accurate, complete or timely. None of the Data Owner, Aegon Asset Management UK plc or any other person connected to, or from whom Aegon Asset Management UK plc sources, 3rd Party Data is liable for any losses or liabilities arising from use of 3rd Party Data.

Aegon Asset Management Investment Company (Ireland) Plc (AAMICI) is an umbrella type open-ended investment company which is authorised and regulated by the Central Bank of Ireland. Aegon Investment Management B.V (Aegon AM NL) is the appointed management company. Aegon AM NL is registered with and supervised by the Dutch Authority for Financial Markets (AFM). Aegon AM NL's German branch markets AAMICI in Germany, Austria and Switzerland, is registered with and supervised by the AFM and supervised by BaFin in Germany. Aegon AM NL’s branch in Spain markets AAMICI in Spain, Italy and Switzerland. Aegon AM NL's Spanish branch is registered with and supervised by the AFM and is supervised by the CNMV in Spain. For Switzerland, AAMICI is a UCITS which is authorised for distribution by FINMA as a Foreign Collective Investment Scheme. The Disclosures are available from www.aegonam.com or from the Representative and Paying Agent in Switzerland, CACEIS (SA) Switzerland, Chemin de Precossy 7-9, CH-1260 Nyon / VD, Suisse, Phone: +41 22 360 94 00, Fax: +41 22 360 94 60.

Aegon AM UK markets AAMICI in the UK and otherwise outside of the EEA. Aegon Asset Management UK plc (Aegon AM UK) is authorised and regulated by the Financial Conduct Authority.

Please note that not all sub-funds and share classes may be available in each jurisdiction. This content is marketing and does not constitute an offer or solicitation to buy any fund(s) mentioned. No promotion or offer is intended other than where the fund(s) is/are authorized for distribution.

Please visit www.aegonam.com/en/contact/ for an English summary of investor rights and more information on access to collective redress mechanisms.

Adtrax: 4532546.59 | Expiry 31 August 2025