Climate Insight Series

As climate change intensifies, decarbonisation of the automotive industry is crucial to reducing greenhouse gas (GHG) emissions and fostering a sustainable future. This paper explores the approaches required to achieve significant reductions, including advancements in electric vehicle technology, the integration of renewable energy sources, and the implementation of stringent regulatory policies. By examining the current state of the industry and projecting future trends, we aim to illustrate the clear pathway for transitioning to a low-carbon automotive sector.

Net Zero pathway for 2023 and beyond

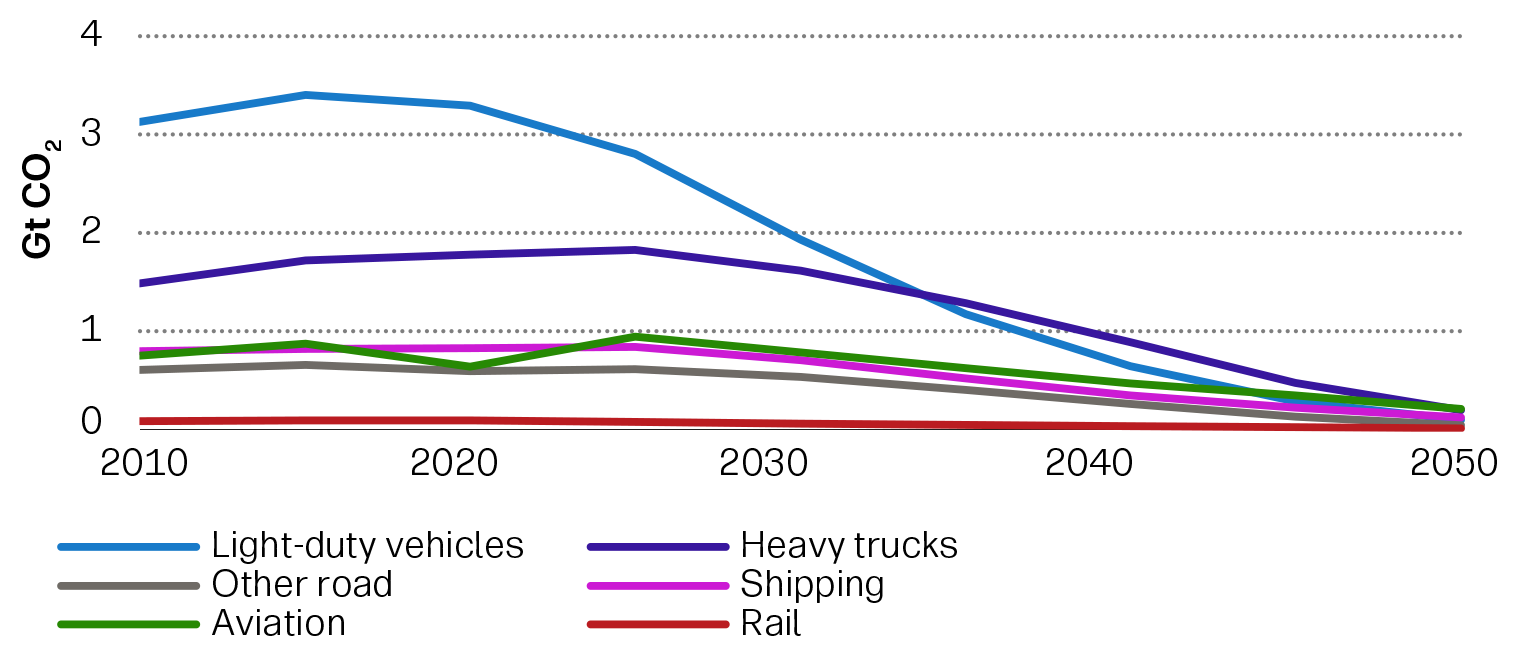

The International Energy Agency (IEA) reports that the transportation sector currently accounts for approximately 24% of global CO₂ emissions1. Within this sector, automobiles (including passenger cars and light-duty trucks) contribute around 45% of transportation emissions2. Under its Net Zero Emissions scenario, the IEA suggests that to meet the goals of the Paris agreement by 2030, around 60% of all cars sold must be electric (including battery, plug-in hybrid or fuel cell vehicles). Additionally, from 2035, there should be no new sales of internal combustion engine (ICE) vehicles3.

However, the transition in the sector is not on track for 2030 goals or the 2050 net zero targets. According to the IEA, to align with the Net Zero Emissions (NZE) by 2050 Scenario, CO₂ emissions from the transport sector must fall by more than 3% per year until 20301. Strong regulations, fiscal incentives, and rapid adoption of zero-emission vehicles, coupled with a clean electric grid, are essential for deep decarbonisation.

Figure 1: Evolution of the IEA's NZE scenario

Source: IEA

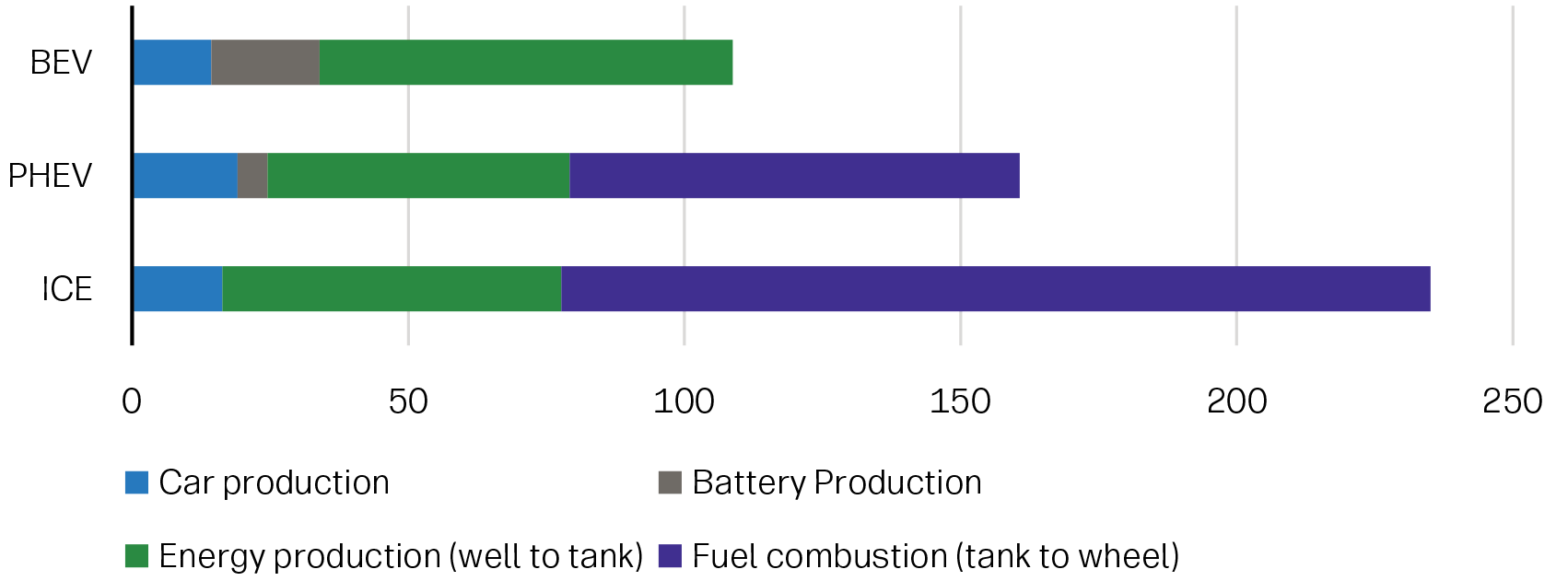

The promise of BEVs to reduce transportation emissions

A range of commercially viable technologies have emerged to electrify autos, contributing to the sector’s recent successes. Among these, battery electric vehicles (BEVs) stand out as the main technology for significantly lowering emissions and paving the way towards net zero. BEVs boast approximately 54% lower lifecycle emissions than internal combustion engine (ICE) models. This reduction is achieved by considering both well-to-tank and tank-to-wheel emissions (see chart below). In contrast, plug-in hybrid vehicles (PHEVs) achieve roughly 32% lower emission than ICE vehicles. This indicates that PHEVs alone can’t achieve the net zero emissions target, which requires 45% absolute reduction in emissions by 2030. Therefore, the widespread adoption of BEVs and other zero-tailpipe technologies is crucial for both short and long-term decarbonisation efforts.

Figure 2: Life-cycle GHG emissions for medium-size cars in 2021

Source: IEA. www.iea.org/data-and-statistics/data-tools/ev-life-cycle-assessment-calculator

The lifecycle emissions of BEVs: A clear pathway for decarbonisation

The lifecycle emissions of BEVs highlight a clear pathway for decarbonisation. By investing in cleaning up the grid4 and moving away from fossil fuels, we can further reduce the lifecycle emissions of BEVs. While it is commonly known that BEVs have higher manufacturing emissions due to battery production and supply chain factors, their tailpipe emissions are significantly lower over their lifespan. BEVs have lower CO₂ emissions but higher NOx and N2O emissions, which have a higher global warming potential (GWP). Therefore, focusing purely on CO₂ emissions may result in unintended consequences.

Goldman Sachs expects battery prices for BEVs to drop significantly in the coming years due to advancements in energy density and lower costs, in conjunction with lower commodity prices for cobalt and lithium from the highs of 2020-235. In the future solid-state batteries, which promise increased energy density, may replace lithium-ion batteries. However, manufacturing these batteries from test environments to factory scale has proven challenging. Regardless, the market expects BEV battery chemistry to change over the decade, with costs continuing to come down.

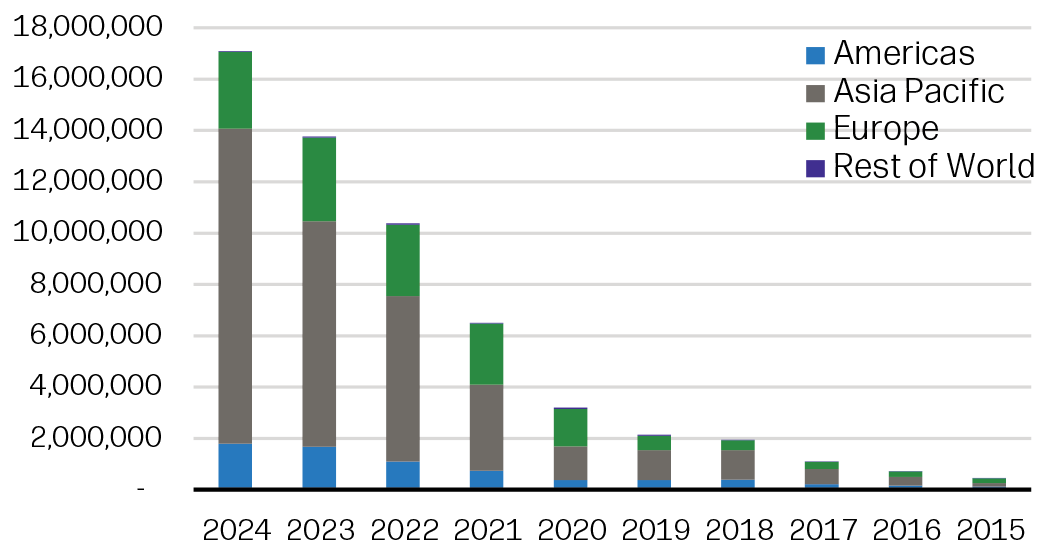

These advancements have led to significant sales growth globally, especially in China. In 2023, Global BEV sales climbed to 14m new registrations, accounting for 18% of all new car sales. China dominated this adoption, contributing nearly 60% of this rise with almost 8.2m EVs sold in 2023. In 2024, global EV sales experienced a 24% increase, with China and Asia Pacific leading the way with 40% annual sales growth. The Chinese market has benefited from range-extender technology and government car trade-in schemes6. In the Americas, sales grew by 8% while Europe saw a decline of 8% in annual sales. Due to the removal of subsidies in larger markets. Meanwhile, the US showed relatively good growth, but 2025 is expected to become more difficult with the threat of reversing tax credits from the Biden era. In 2024, total car sales reached 74.6m7, with BEVs accounting for approximately 23% of the market share. To reach the IEAs net zero scenario, where BEVs represent 60% of car sales by 2030, new BEV sales would need to increase 2.6 times, reaching nearly 45m vehicles sold, using 2024 as the base year.

Figure 3: Growing global BEV sales show promise, but more is needed to reach net zero milestones by 2030

Source: BNEF & Rho Motion, author's own calculations

Pullback on BEV manufacturing by some OEMs

While many Original Equipment Manufacturers (OEMs) are still aiming for 100% EV sales by 20358, the past year has seen some manufacturers pullback their commitments related to EV manufacturing volumes and adjusting their capital investments. This pullback is due to a combination of factors, primarily a drop in BEV demand and a desire to avoid over investment given market growth in 2024. For instance, Ford reported an average loss of $48,000 per BEV in 20249 due to lower- than-expected demand for its products and has since cancelled many three-row BEVs, switching to PHEV instead. Similarly, GM has lowered its production targets and is retooling its BEV full-size truck plants10. Some manufactures do not deploy flexible manufacturing practices and produce EVs and ICEs in different plants since some manufacturing configurations are distinct.

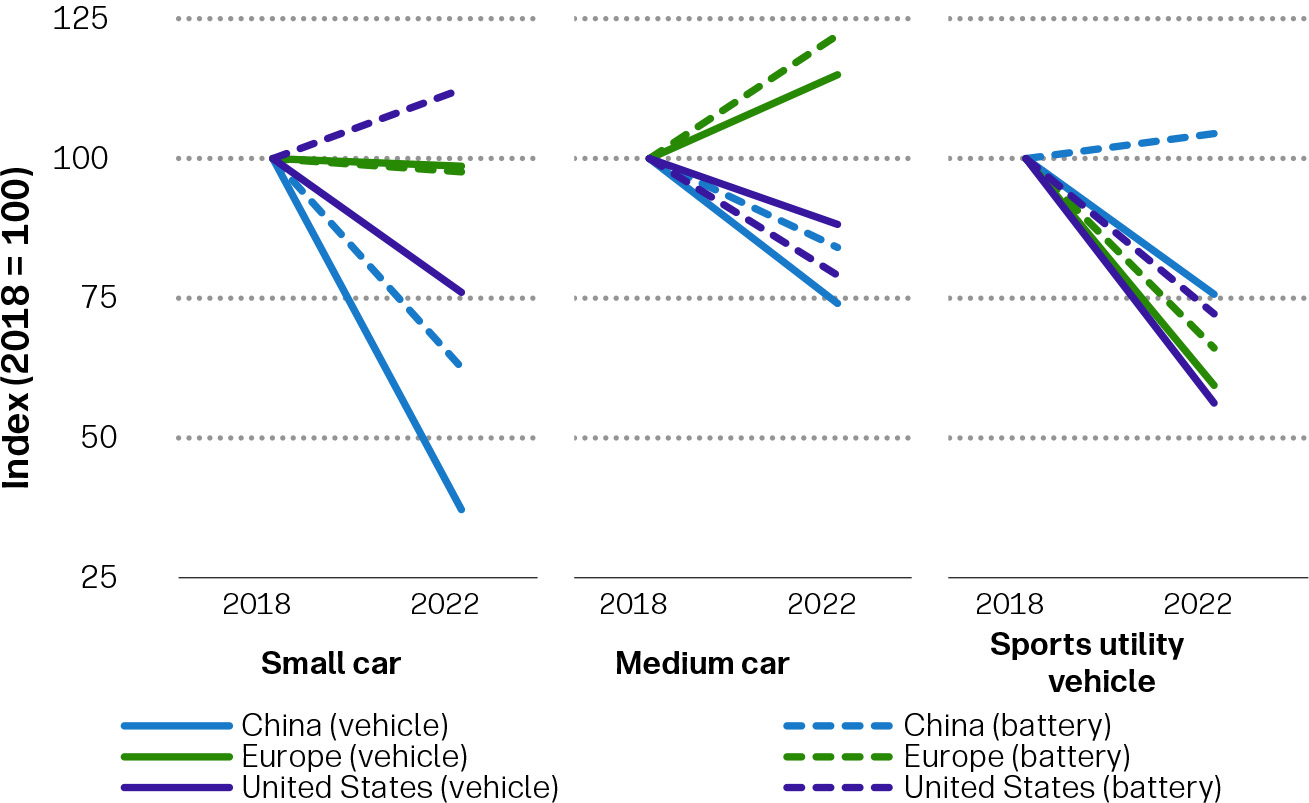

BEV price premium and future price expectations

Historically consumers have looked at the price premium of EVs based on the time required to recoup the premium through fuel cost savings. Recently, concerns have shifted towards the resale values of EVs, with many believing that EVs will be cheaper in the near future. During the covid years, OEMs made a big push to increase manufacturing volume, saturating many markets. Various tax incentives to purchase or lease EVs have also skewed demand in recent years. However, assuming battery cost expectations hold true, and oil prices remain relatively high, BEVs should have significant cost advantages, potentially driving demand back up in the long term.

As illustrated by the figure below, a closer examination of regional costs and vehicle sizes reveals why BEV adoption has been so successful in China compared to other regions. Costs have come down significantly across almost every vehicle size and region.

Figure 4: Weighed average price and battery cost per region

Source: IEA World Energy Investment 2024,

www.iea.org/reports/world-energy-investment-2024

New charging technologies

The Chinese brand BYD has introduced a charging technology that promises to deliver 400km of range in just 5 minutes. In comparison, the Ford Mach-E offers 66km of range with a similar charging time. This development is expected to alleviate ‘charge anxiety’ among new EV consumers and increase adoption rates.

Another innovative solution comes from the Chinese company NIO, which has recently come up with an alternative solution to reduce the burden on EV charging by using battery swapping. NIO has focused on high-usage areas and routes, building a battery-swap network that reached over 15 million swaps by the end of 2022, with an average of 40,000 swaps per day. However, this business model faces challenges due to higher operating costs, and setting a common industry standard for battery design would greatly increase adoption11.

Conclusion

The transition to electric vehicles and the decarbonisation of the automotive industry is a complex challenge that requires coordinated efforts from governments, automakers, energy providers, and consumers. While significant progress has been made, the current pace of adoption and regulatory policies are not sufficient to achieve the ambitious targets set by the Paris Agreement and the IEA's Net Zero Emissions scenario.

Overcoming barriers such as the initial higher cost of EVs, range anxiety, and the need for a robust charging infrastructure is crucial to accelerating the widespread adoption of electric vehicles. Governments must continue to provide strong incentives, implement stringent emissions regulations, and invest in renewable energy sources to support the growth of a clean electric grid.

The transition towards electric vehicles in the automotive sector is not following a linear path but rather a classic S-curve adoption pattern. Currently, Chinese automakers are gaining market share over Western and Japanese companies, especially in emerging markets. If this trend continues, it could give Chinese firms a potential cost and technology advantage, posing a challenge for traditional automakers falling behind in the EV transition12.

Looking ahead to 2050, the electrification of the transportation industry is crucial for achieving net zero emissions. Electrifying all transportation models (including autos and other vehicles) could reduce CO₂ emissions13 by more than 80%.

Source

1 https://www.iea.org/energy-system/transport

2 https://www.iea.org/data-and-statistics/charts/global-co2-emissions-from-transport-by-subsector-2000-2030

3 https://iea.blob.core.windows.net/assets/deebef5d-0c34-4539-9d0c-10b13d840027/NetZeroby2050-ARoadmapfortheGlobalEnergySector_CORR.pdf

4 When analysing lifecycle emission studies, it’s important to observe the assumptions tied to the electricity mix used in the study.

5 https://www.goldmansachs.com/insights/articles/electric-vehicle-battery-prices-are-expected-to-fall-almost-50-percent-by-2025

6 https://rhomotion.com/news/over-17-million-evs-sold-in-2024-record-year/

7 https://www.acea.auto/publication/economic-and-market-report-global-and-eu-auto-industry-full-year-2024/#:~:text=In%202024%2C%20global%20car%20sales,region%20recording%20a%203.8%25%20growth.

8 https://investor.gm.com/news-releases/news-release-details/general-motors-largest-us-automaker-plans-be-carbon-neutral-2040

9 https://qz.com/ford-ev-costs-50-000-1851608327#:~:text=The%20company%20posted%20a%20loss,slash%20costs%20by%20%24400m.

10 https://www.spglobal.com/mobility/en/research-analysis/behind-the-headlines-oems-gently-braking-on-ev-investment.html

11 https://hbr.org/2024/05/how-one-chinese-ev-company-made-battery-swapping-work

12 https://carbontracker.org/electric-drive/

13 https://www.sciencedirect.com/science/article/pii/S2666791623000179